The collapse of the U.S. housing bubble sent the world spiraling into recession. Could the collapse of energy and the bursting of the commodity bubble be just as damaging? Very few Wall Street experts are willing to even use the term “bubble” with regards to the boom and bust in the price of oil, copper, iron ore and other materials.

As with housing, there was a fundamental reason for these prices to soar. China has been on a historic commodities binge as it doubled the size of its economy in recent years to become the second largest economy surpassed only by United States.

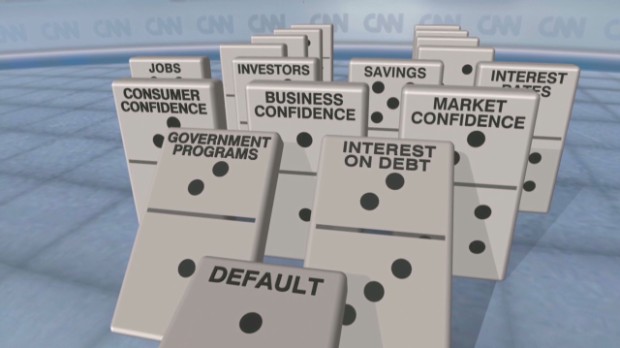

A feeding frenzy of financing, mining, fracking and deal making intensified the boom and now, the bust as China’s growth and appetite for such raw materials has slowed dramatically. You can add Canada, Australia, Brazil, Japan and Russia to the domino picture below:

The U.S. economy is among the least directly damaged by this unwind but that does not mean the country will escape unscathed. For starters, the slowdown in world trade has already damaged profits of big corporate multinationals and transportation providers. The transportation EFT (XTN) is down 20% compared to the S&P 500 which is almost flat for the year.

Cracks have been forming in the high yield bond market from the realization that the price of oil will not be recovering anytime soon. (junk bonds) The possibility of oil fracking companies defaulting on their loans has caused a stampede to the exits. U.S. investors have been pulling money out of high yield mutual funds at the fastest pace in over a year.

Third Avenue Management said on Thursday it was shutting the doors of its $800m high-yield bond fund because it had run out of money to pay redeeming investors without having to dump bonds at fire-sale prices.

The chart below of two popular high yield ETFs illustrates the rapid decline in their price that started back in June 2015.

Many Wall Street traders and hedge fund managers have been betting on a recovery in the price of oil. The collapse in oil below $40.00 a barrel last week has caused them to panic and caused the market to selloff.

In my humble opinion, I expect more tax loss selling this week. Plus hedge fund managers will probably try to recover some of their losses by going short oil and adding more downward pressure to the price of oil stocks.

The next domino to fall could be investor’s confidence leading to equity mutual fund redemptions. This could force fund managers to sell some of their more liquid big cap names like Facebook, Amazon, Netflix and Google which have been big market winners’ during 2015. Some fund managers will also be selling some other winners to avoid sending out tax forms in 2016 to their shareholders with capital losses.

There are two important events that I will looking at closely this week. The first is the wording of the Fed statement regarding the pace of interest rate hikes expected for 2016. The second is the stock market reaction to the triple witching of options that expire on Friday. It can be a down day for U.S. stock markets!

Triple Witching Definition from Investopedia

An event that occurs when the contracts for stock index futures, stock index options and stock options all expire on the same day. Triple witching days happen four times a year on the third Friday of March, June, September and December.

Good article. I’m actually out of the market until after the Fed and possibly Friday. I’m thinking if we get a Santa Rally at all this year it will be next week. You’ve heard the term buy the rumor sell the news. I’m actually thinking the opposite will be in effect. Sell the rumor and buy after the market has a chance to digest the news.

LikeLike

Thanks, I hope that you are right and Santa shows up on Wall Street. I have some doubts.

LikeLike

Well, I did say ‘if’. 😉

LikeLike

Looking at the downturn in stock market in the second half of this week, it looks like you definitely made the right call on holding off on putting more $$ in. What a mess! Not sure where the heck the market will go from here. It’s not looking too good though. Thankfully, I am in it for the long haul!

LikeLiked by 1 person

Yes, it was a text book buy on rumor and sell on news week. I don’t know why triple witching Fridays tends to be a down day but even I was surprised by the size of the fall in prices.

LikeLiked by 1 person