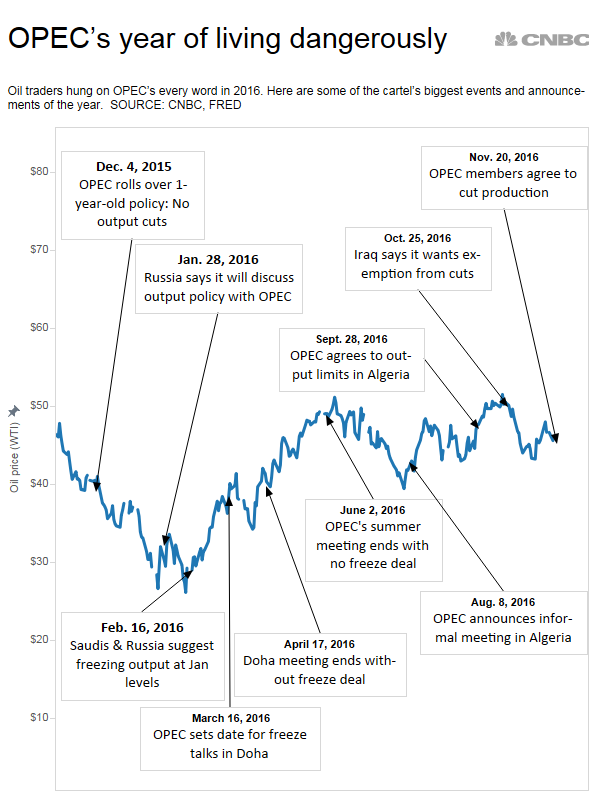

Over the past year there has been a lot of talk regarding the possibility of OPEC either freezing or cutting production. The Organization of the Petroleum Exporting Countries (OPEC) on Wednesday agreed to its first oil production limits in eight years, triggering an oil rally. The new norm for crude prices could be between $50 and $60 going forward.

OPEC has said it is seeking to secure 600,000 barrels per day of cuts from non-OPEC producers, and that Russia has committed to temporarily cut production by about 300,000 barrels per day in the first half of 2017. Russia and other non-OPEC producers are set to meet with OPEC on Dec. 9.

The key to all of this is whether these cuts will be implemented. Plus market watchers are also questioning whether the oil group will cheat. The sharp oil-price rally may well be short-lived, as oil production has been turning the corner in the U.S., with the rig count up 50 percent from lows in May.

Extracting oil from the Permian Basin, which spans west Texas and southeast New Mexico, is less expensive than it is in many major fields.

“Basically, $50 is good for Permian Basin stocks,” said Paul Sankey, senior oil and gas analyst at Wolfe Research. Pioneer Natural Resources and EOG Resources expanded their presence in the region in the last few months, and Sankey said the two companies would also benefit from $50 oil.”

In Conoco Phillips’ third-quarter conference call, management said the company was adding three rigs to its operations in the North Dakota Bakken oil fields for a total of four rigs in the region.

“The Trump Wild Card”

Cutting corporate income taxes will make U.S. shale producers more profitable and they could have extra cash to produce more oil. Less banking regulations could also allow more bank loans to the energy industry. Could Trump impose tariffs on imported oil? He is after all unpredictable!

The oil futures market has quotes for monthly contracts that are being offered at $53.00 for the first quarter of 2017 and $55 for the rest of the year. The trading volumes of contracts changing hands is very low which could be a bullish sign that oil producers believe that higher prices are coming.

Now over the last two years, I have avoided investing in oil stocks and posted many articles regarding the oversupply problem. I am currently doing research on some U.S. shale oil producers. Unfortunately, the fundamentals haven’t changed and most companies are still losing money at current oil prices.

What do you think?

Is this another suckers rally because hedge funds are rushing in to cover their short positions or is this the start of a bull market in the oil patch?

Good questions… I have no idea… Right now, I own rdsa and have ITM covered calls. I will roll at the same strike. I guess that assumes I expect oil to be stable.

LikeLike

I think that the 7% dividend that you get from owning RDS.A will keep the share price stable more than the price of oil. The same holds true for BP which has a 6.7% yield.

LikeLike

You are probably right… That puts some serious support under the stock.

LikeLike

I hadn’t thought about it, but it probably is a suckers rally.

LikeLiked by 1 person